How mid-sized companies are preparing for the PFAS ban

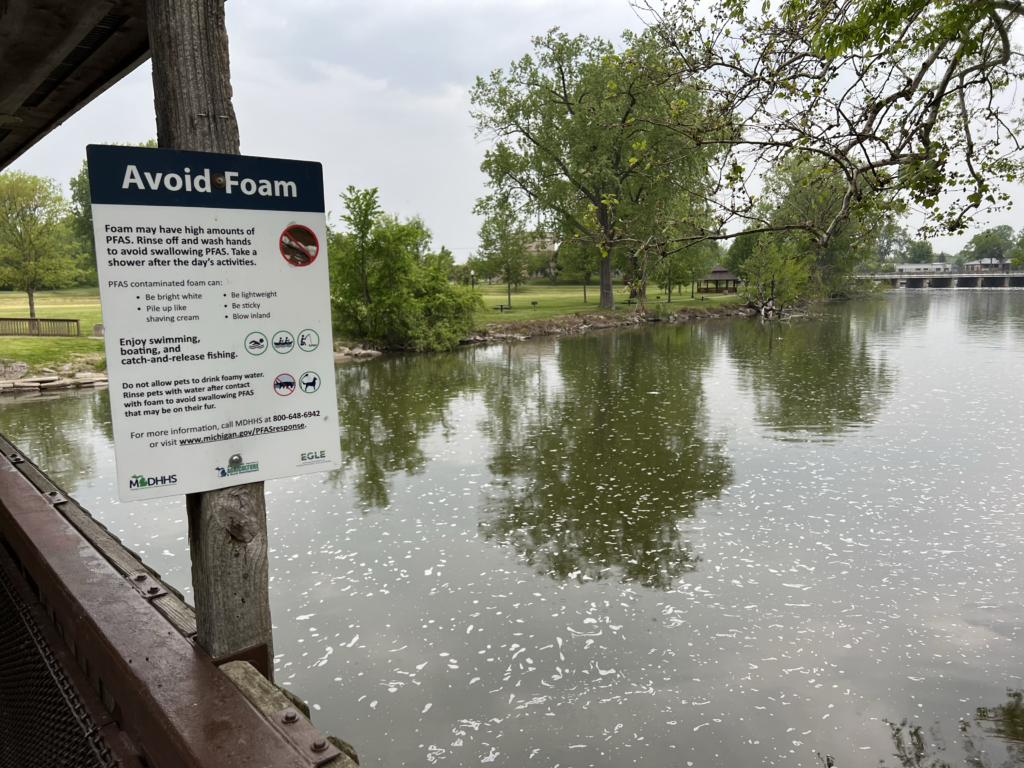

Image: Wikimedia Commons

How mid-sized companies are preparing for the PFAS ban – Regulatory pressure from the EU and the impact on the sealing industry.

May 28, 2024 – The European Union’s initiative, which aims to make Europe the first climate-neutral continent by 2050 and decouple economic growth from resource use, consists of a broad legislative package. This spans numerous regulatory areas, including the PFAS ban, and also has significant implications for the sealing industry.

Much ado

The planned PFAS ban is causing a lot of uproar across the board. The relevant dossier was prepared by authorities in Denmark, Germany, the Netherlands, Norway and Sweden and submitted to the European Chemicals Agency (ECHA) on Jan. 13, 2023. It aims to reduce emissions of per- and polyfluorochemicals (PFAS) to the environment and make products and processes safer. It includes a general ban on all PFAS, including fluoropolymers (FP), with exceptions for certain applications.

Problems

The file’s problem for the sealant industry – especially medium-sized companies – is the lack of alternatives to certain FP and the feasibility of the ban along complex supply chains. More than 5,600 comments submitted to ECHA during the six-month consultation phase are currently being evaluated before a decision is made by the European Commission – with the involvement of member states. Thus, the final word has not yet been spoken.

Just the tip of the iceberg

However, the PFAS restriction issue does not stand alone, but is only the tip of the iceberg. The legislature is also dealing with regulation of bisphenols, enacting supply chain laws and revising packaging regulations. All these regulatory changes are creating turmoil in the marketplace. For example, one of the largest FP manufacturers Dyneon 3M has withdrawn from the market in response to the PFAS ban. Solvay announced that it will no longer confirm FDA approvals for its FP and that the switch to fluorosurfactant-free (FSF) elastomers is underway. There is great uncertainty in the market and increasing demands on the user side, which is particularly challenging for medium-sized companies.

Major implications

How should we deal with these new dynamics? The chemical industry is already calling for more balance in the European Commission’s next mandate and is seeking an industrial deal to balance the European Green Deal. But that is something of the future and alone is not enough. A fundamental rethink is needed that allows medium-sized companies to structurally adapt to these changes. It is no longer enough to simply be a market specialist; your skills must be expanded. The company Meweo has therefore decided to offer a new service called MeweKomp. Regulatory developments are closely monitored and structurally integrated into the company’s services. The advisory services not only ensure compliance, but also future-proof investment decisions.

Source: ChemManager

Also read: ECHA optimizes consultations on biocides

Reservation

This information has been compiled with the greatest possible care, in some cases from different information sources. (Interpretation) errors are not excluded. No legal obligation can therefore be derived from this text. Everyone dealing with this subject has the responsibility to delve into the matter!